taxable income malaysia 2017

The amount of discount received is taxable too. Corporate Income Tax In Malaysia Acclime Malaysia Malaysia Advanced American Tax Malaysia Market Profile Hktdc Research 2 1 Qi Group Arena Multimedia Lahore Center 8 Days Adobe.

Malaysia Total Revenue From Sin Tax On Alcoholic Beverages 2018 Statista

RM5000 - RM20000.

. An approved individual under the Returning Expert Programme who is a resident is taxed at the rate of 15 on income in respect of having or exercising employment with a person in Malaysia. RM100000 - RM250000. Leasing income from moveable property derived by a permanent establishment in Malaysia is taxed.

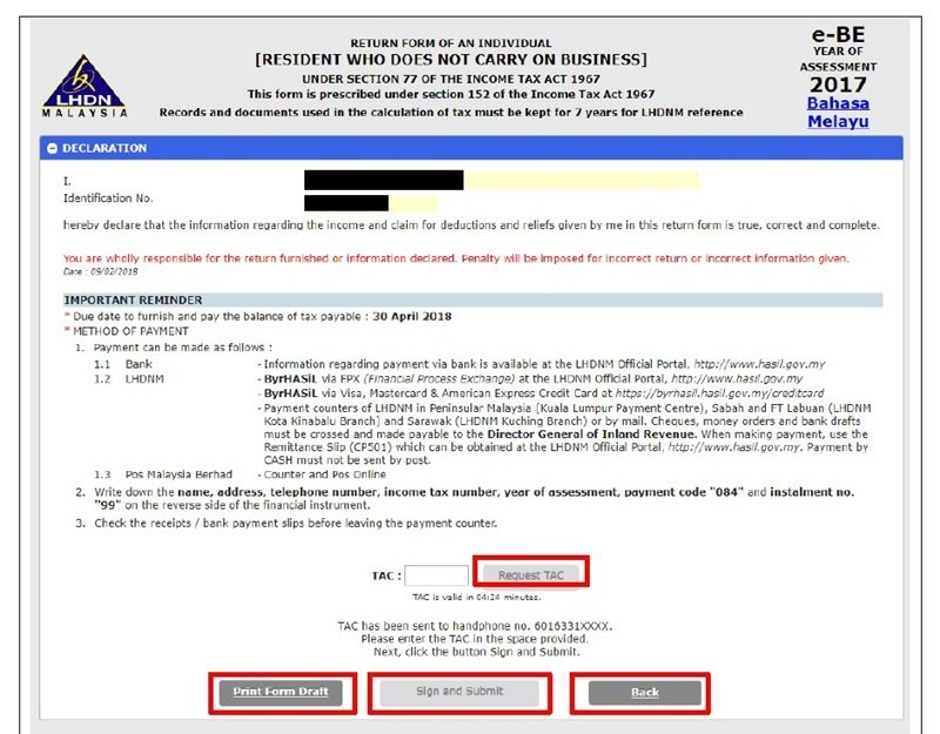

8 June 2017 Page 4 of. Income Tax Monthly Deduction Table 2017 Malaysia. Lhdn income tax reliefs actually paying a lot more malaysia personal guide 2019 individual how to calculate monthly pcb malaysian relief.

For chargeable income in excess of MYR 500000 the corporate income tax rate is 25. A qualified person defined who is a knowledge. Up to RM5000.

THE government has made a surprising U-turn on Dec 30 2021 after announcing that foreign-sourced income received in Malaysia by Malaysian tax residents will be taxed. ANNUAL INCOME RM MONTHLY INCOME RM Self Single Widower Divorcee Spouse with no source of Income. Income Tax Exemption No.

Rent Youll be taxed if you gain profit from renting a house land vehicle or even goods used by someone where you receive. 9 Order 2017 The above order gazetted on 24 October 2017 exempts a NR from payment of tax on income under sections 4Ai ii which is rendered. Average Lending Rate Bank Negara Malaysia Schedule Section 140B.

INLAND REVENUE BOARD OF MALAYSIA INCOME TAX TREATMENT OF GOODS AND SERVICES TAX PART II QUALIFYING EXPENDITURE FOR PURPOSES OF CLAIMING ALLOWANCES. Married with no Child. RM20000 - RM35000.

Income range Malaysia income tax rate 2017. RM70000 - RM100000. RM50000 - RM70000.

A non-resident individual is taxed at a flat rate of 30 on total taxable income. A non-resident individual is taxed at a flat rate of 30 on total taxable income. 12017 Date of Publication.

Effective for year of assessment 2017 tax filed in 2018 the lifestyle tax relief at a limit of RM2500 yearly also includes new categories such as the purchase of printed. Restriction On Deductibility of Interest Section 140C Income Tax Act 1967 International Affairs. The amount of tax relief year 2017 is determined according to governments graduated scale.

INLAND REVENUE BOARD OF MALAYSIA INCOME TAX TREATMENT OF GOODS AND SERVICES TAX PART I EXPENSES Public Ruling No. RETURN ON REMUNERATION FROM EMPLOYMENT CLAIM FOR DEDUCTION AND PARTICULARS OF TAX DEDUCTION UNDER THE INCOME TAX RULES DEDUCTION FROM REMUNERATION. RM35000 - RM50000.

2017 the income tax imposed for the first RM 10 million will be 24 ie the chargeable tax will be RM 24 million whereas the remaining RM 2 million will be taxed at 20 ie the. Under the existing rules only the monthly fees of 5 on the gross turnover is subject to 10 withholding tax while the 2 on overseas marketing is not subject to.

Mobility Basics What Are Tax Equalisation And Tax Protection Eca International

Standard Deduction 2020 2021 What It Is And How It Affects Your Taxes Wsj

Relief For Small Business Tax Accounting Methods Journal Of Accountancy

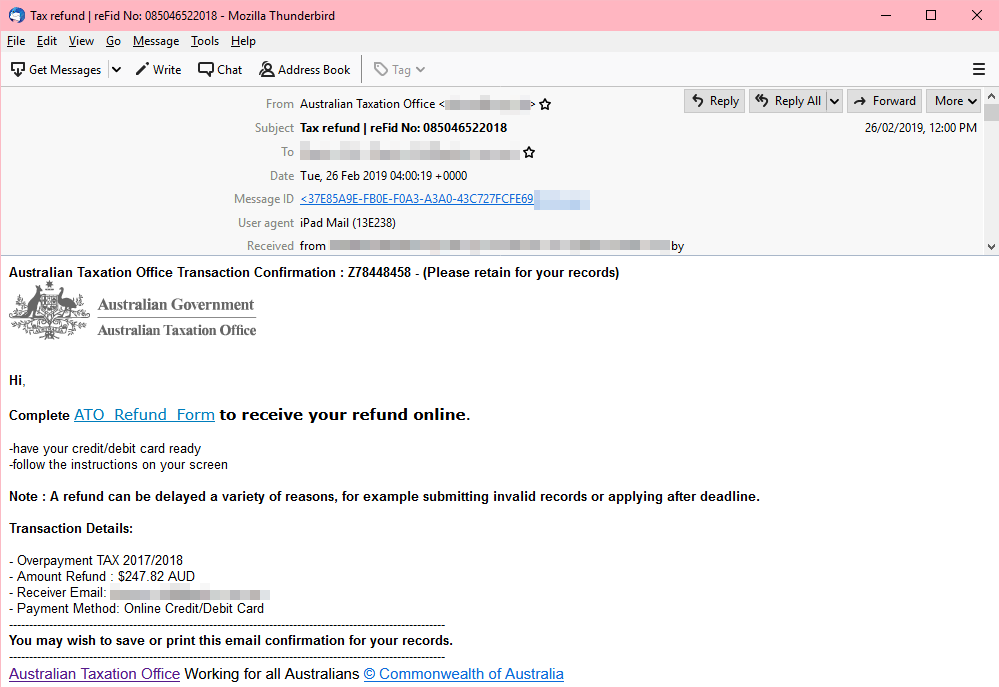

What You Need To Know About Tax Scams Security News

Corporate Tax Rates Around The World Tax Foundation

Malaysia Total Revenue From Sin Tax On Cigarettes And Tobacco Products 2018 Statista

Malaysia Personal Income Tax Guide 2020 Ya 2019

What Is The Difference Between The Statutory And Effective Tax Rate

Income Tax Malaysia A Definitive Guide Funding Societies Malaysia Blog

Malaysian Tax Issues For Expatriates And Non Residents Toughnickel

Income Tax Calculator 2021 Malaysia Personal Tax Relief Malaysia Tax Rate

What Are The Sources Of Revenue For State Governments Tax Policy Center

Income Tax Malaysia 2018 Mypf My

Cover Story Budget 2020 Top Tax Bracket Raised To 30 Tin Number Proposed The Edge Markets

Corporate Tax Rates Around The World Tax Foundation

/TaxableIncome_Version1_4188122-635a1cf2f69a48f5bdcc697eb075b5a4.png)

Taxable Income What It Is What Counts And How To Calculate

Business Tax Deadline In 2022 For Small Businesses

Policy Basics Where Do Federal Tax Revenues Come From Center On Budget And Policy Priorities

Malaysia Income Tax Guide 2016

0 Response to "taxable income malaysia 2017"

Post a Comment